child tax credit portal phone number

Earned Income Tax Credit is calculated by the amount of earned income you received. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially.

I Got My Refund Ctc Portal Updated With Payments Facebook

To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

. For example if you call the IRS business phone number you wont get the answer youre looking for as the representatives at the end of the line arent going to have them. It is a tax law resource that takes you through a series of questions and provides you with responses. For all other tax law inquiries visit the Interactive Tax Assistant on irsgov.

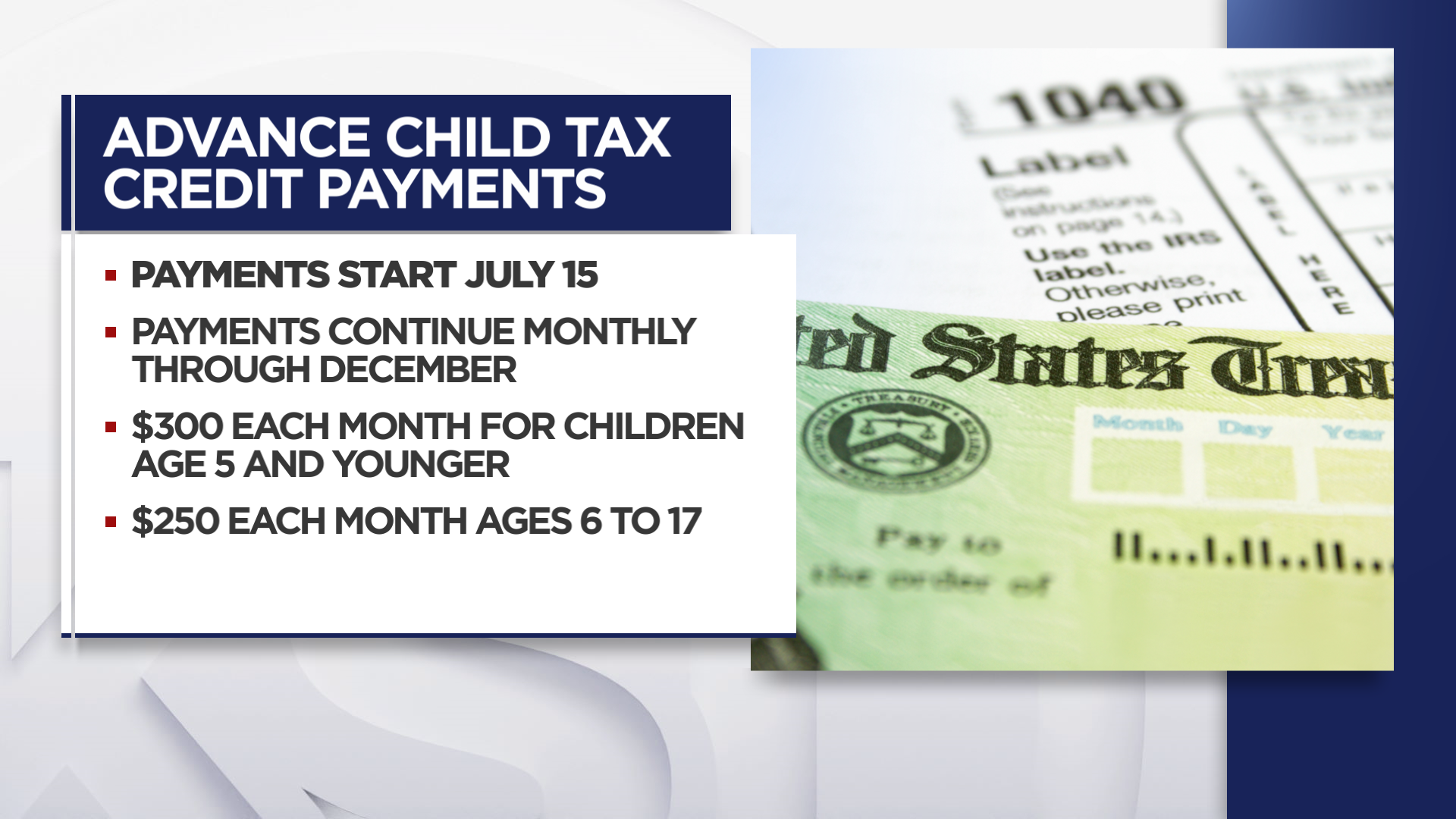

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. The Child Tax Credit provides money to support American families. The Child Tax Credit CTC provides financial support to families to help raise their children.

Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. Making a new claim for Child Tax Credit.

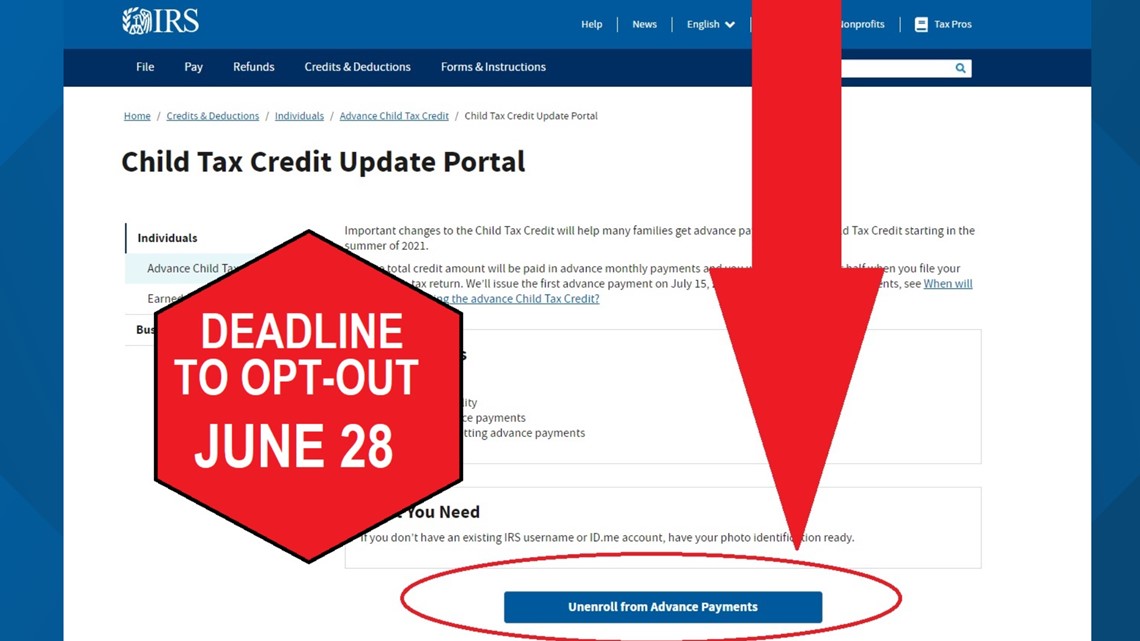

44 2890 538 192. If you dont have internet access or cant use the online tool you can unenroll by contacting the IRS at the phone number on your Advance Child Tax Credit Outreach Letter you. Individual Income Tax Attorney Occupational Tax.

The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Have been a US. Call the IRS about.

Child Tax Credit. Already claiming Child Tax Credit. The amount you can get depends on how many children youve got and whether youre.

You can see your advance payments total in. These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Dial 18001 then 0345 300 3900. IMPORTANT INFORMATION - the following tax types are now available in myconneCT. The Administration collaborated with a non-profit Code for America.

If you have oneClick this link to see the Child Tax Credit Update Portal. The deadline to sign up for monthly Child Tax Credit payments is November 15. Here is some important information to understand about this years Child Tax Credit.

Many families received advance payments of the Child Tax Credit in 2021. Find answers about advance payments of the 2021 Child Tax Credit. Make sure you have the following information.

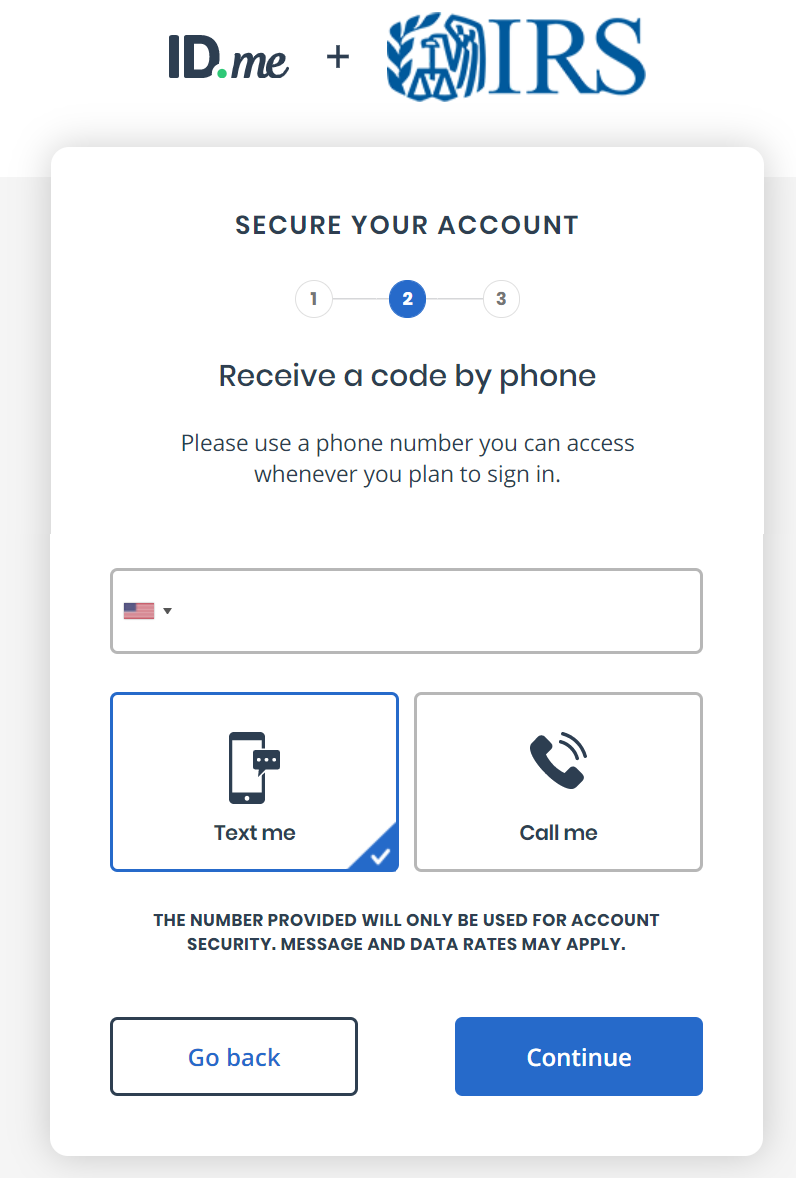

E-mail address or phone. Choose the location nearest to you and select Make Appointment. Learn about the child tax credit which will help you to claim tax credit for children under the age of 18.

You can also use Relay UK if you cannot hear or speak on the phone. Page 1 of 1 2022 Child Tax.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Access The Irs Child Tax Credit Update Portal Kindred Cpa

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Irs Child Tax Credit Portal Open For Parents Who Want To Opt Out Of The Monthly Payments 5newsonline Com

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

Don T Miss Out On The Expanded Child Tax Credit Advocates For Ohio S Future

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

Families Can Now Register For Child Tax Credit Payments

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Childctc The Child Tax Credit The White House

Taxpayer Advocate On Twitter If You Ve Moved Update Your Address By Midnight Eastern Time On October 4th To Change Your Mailing Address For Your October Advance Child Tax Credit Payment Use The

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit What We Do Community Advocates

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com